Registration of EPF or SOCSO

Registration of EPF and SOCSO is required for a Malaysian company when it hires employees to operate a business. The company has to contribute to the EPF fund based on the required rate. If you need this registration, please click the following button and order online.

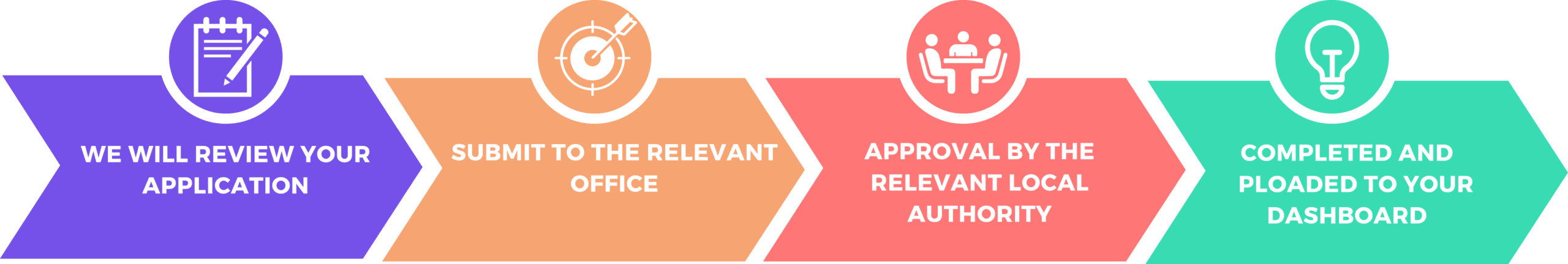

Processing steps of your applications

Frequently Asked Question

What is an employee provident fund (EPF)?

The employee provident fund (EPF) is a mandatory savings scheme for private sector employees in Malaysia. It is administered by the EPF Department, which falls under the Ministry of Finance. The EPF was established in 1951 with the passing of the Employees’ Provident Fund Ordinance. Employees contribute a specified percentage of their monthly income to their EPF account, while employers are required to match these contributions.

What is the current EPF rate?

In Malaysia, the statutory rates for contributions to the Employees Provident Fund (EPF) are currently set at 11% for employees and 12% for employers. However, employees may choose to contribute more than the minimum required amount, and employers may also voluntarily contribute additional amounts on behalf of their employees.

Is it mandatory for a company to contribute to the EPF fund?

According to the Employment Provident Fund Act of Malaysia, all registered companies are required to contribute to the EPF on behalf of their employees. The amount that each company contributes is based on a percentage of the employee’s salary, and the current rate is set at 12%. Employers who fail to make the required contributions can be fined.

Is it compulsory for foreign employees to contribute to EPF?

Foreign employees don’t need to contribute to EPF in Malaysia. However, they may voluntarily do so if they wish. There are many factors to consider when deciding whether or not to contribute to EPF, such as whether the employer will match contributions and what the employee’s tax liabilities will be. Ultimately, it is up to the individual employee to decide whether or not contributing to EPF makes financial sense for them.

How to make EPF payments?

You can make payments online through the EPF website or your bank’s online banking portal. If you’re making a one-time payment, you’ll need to use a credit or debit card. You can set up a direct debit from your bank account for regular payments. Once you have made your payment, you will be given a receipt which you should keep for your records.

Is KWSP and EPF the same?

The Employees Provident Fund (EPF) is a defined-benefit pension scheme in Malaysia, Singapore, and the United Kingdom. In the UK, KWSP or Kumpulan Wang Simpanan Pekerja is the acronym for EPF; in Malaysia, it’s commonly known as KWSP or Kumpulan Wang Sim.

How can I check my EPF balance?

To check your EPF balance in Malaysia, you can use the i-Akaun app or website. You’ll need to create an account and log in with your NRIC and registered mobile phone numbers. Once you’re logged in, you’ll be able to view your current EPF balance as well as your contribution history.

What is Social Security Organization (SOCSO)?

The Social Security Organisation (SOCSO) is a government-run organisation that provides social security protection to employees in the private sector. Employees who are covered by SOCSO are entitled to receive cash benefits and medical treatment in the event of sickness, maternity, injury, or death.

In Malaysia, the earliest age you can withdraw your EPF is 55. However, you must meet the following criteria in order to be eligible for withdrawal:

- You have reached the age of 55 years;

- You have ceased to be an employee (voluntarily or involuntarily); and

- You have met the minimum retirement sum.

How much an employee has to contribute to SOCSO?

In Malaysia, the amount an employee pays for SOCSO (Social Security Organisation) varies depending on their income. For those earning less than RM1,000 per month, the contribution is RM10. In contrast, those earning more than RM4,000 per month must pay RM151. Employees who earn between these two amounts contribute a gradually increasing amount based on their salary.

For most employees, the contribution is deducted from their salary by their employer and then paid over to SOCSO. Self-employed individuals or those who work in the informal sector may have to make voluntary contributions. As of 2019, the maximum monthly benefit that an individual can receive from SOCSO is RM1,200.

Is it mandatory for a company to contribute to SOCSO?

Yes, it is mandatory for companies registered in Malaysia to contribute to SOCSO. The Social Security Organization (SOCSO) is responsible for the social security protection of Malaysian workers. Employers are required to make monthly contributions towards their employees’ medical, invalidity, and death benefits. Employees are also required to make monthly contributions towards their own social security protection.

Is it compulsory for foreign employees to contribute to SOCSO?

No, foreign employees don’t need to contribute to SOCSO in Malaysia. However, they are still encouraged to do so as it may offer them some protection in case of illness or injury. The benefits provided by SOCSO are generally quite limited, so it is essential to weigh whether or not it is worth contributing. There are a number of private insurance schemes available that may offer better coverage, so it is worth doing some research to see the best option for you.

How to make payments to SOCSO?

There are a few ways to pay SOCSO:

- By cash or cheque at any SOCSO office

- Through online banking (Maybank2u, CIMB Clicks, and RHB Now)

- At any 7-Eleven outlet in Malaysia (via PayNet)