Labuan company

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

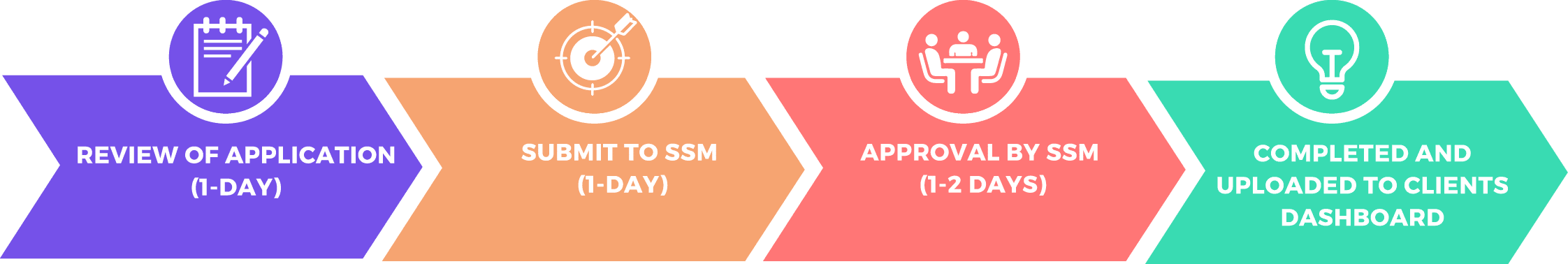

Processing steps and timing of your applications

Frequently Asked Question

What is a foreign company?

A foreign company is a company that is not registered in Malaysia. The Companies Act 2016 defines a foreign company as a company that is incorporated outside of Malaysia, or a company that is registered under the Previous Companies Ordinance. A foreign company must obtain a license from the Malaysian government in order to operate in Malaysia.

What is the difference between foreign and local companies?

The key difference between a foreign and local company is that a foreign company cannot trade shares on the Malaysian Stock Exchange, whereas a local company can. Shares of companies listed on Bursa Malaysia are only open to foreign institutional investors and representatives of overseas Kuala Lumpur-based embassies, high commissions or consulates through the Foreign Investors Representative Office.

Another distinguishing factor between foreign and local companies is that dividends paid by foreign companies to non-residents are subject to a 25%withholding tax, whereas dividends paid to residents are exempt from withholding tax.

What is the advantage of a foreign company in Malaysia?

There are a few advantages of a foreign company in Malaysia.

- The company can enjoy income tax exemption on profits generated from its operations in Malaysia for a period of 10 years, provided it fulfills certain criteria as stipulated under the Malaysia Company Act 2016.

- A foreign company is also exempt from real property gains tax on disposal of its Malaysian business assets.

- A foreign company can enjoy 100% repatriation of capital and profits out of Malaysia, subject to certain restrictions. This means that the company can freely bring back all profits and capital into its home country without any hassle or additional taxes imposed.

- Finally, a foreign company is not required to establish a branch or subsidiary in Malaysia as it can trade through a registered agent.

What are the shortcomings a foreign company?

There are a few potential shortcomings of working with a foreign company.

- First, there may be language barriers that make communication and collaboration difficult.

- Second, there may be differences in business practices that can lead to misunderstandings or conflict.

- Third, foreign companies may be less familiar with local regulations and customs, which can create complications or delays.

- Four, the company might be located in a country with unstable politics or an uncertain legal system, which could make it difficult to do business with them or even to get your money back if something goes wrong.

- Five, it can be more expensive to do business with a foreign company than with one based in your own country.

- Six, a foreign company may not have the same level of trust or credibility as a domestic company.

- Overall, working with a foreign company can be more challenging than working with a domestic company, but it can also offer unique benefits and opportunities.

What is the disadvantage of a foreign company in Malaysia?

There are a few potential disadvantages of foreign companies operating in Malaysia. One is that they may not be familiar with the local business environment and cultural norms, which could lead to misunderstanding or conflict. Another is that they may not be able to access the same level of government support as local companies, which could put them at a disadvantage. Finally, foreign companies may also find it difficult to source local talent, as Malaysian workers may be reluctant to relocate for jobs with foreign companies.

What are the similarities between foreign companies and local companies?

The similarities between a foreign company and a local company include the following:

- Both businesses need to have a sound business plan in place in order to be successful.

- Both businesses need to have a good understanding of their target market.

- Both businesses need to be competitive and offer good products or services that meet the needs of their customers.

- Both businesses should focus on building strong customer relationships.

- Both businesses should strive for continuous improvement in all areas of their business operations.

What are the similarities between foreign companies and local companies?

The similarities between a foreign company and a local company include the following:

- Both businesses need to have a sound business plan in place in order to be successful.

- Both businesses need to have a good understanding of their target market.

- Both businesses need to be competitive and offer good products or services that meet the needs of their customers.

- Both businesses should focus on building strong customer relationships.

- Both businesses should strive for continuous improvement in all areas of their business operations.

How to register a foreign company in Malaysia?

According to the Malaysian Company Act 2016, any foreign company that wishes to register in Malaysia must first appoint a company secretary who must be a Malaysian citizen. Once the company secretary is appointed, the foreign company must then submit an application to the Registrar of Companies along with certain required documents. The required documents typically include the following:

- A copy of the certificate of incorporation or registration from the country of origin

- A copy of the Memorandum and Articles of Association

- A list of directors and shareholders

- An draft memorandum and articles of association for the proposed Malaysian company

- The company's Articles of Association or Constitution must comply with Malaysian law

- Information on the proposed registered office address in Malaysia

- The company must have a branch office or representative office in Malaysia.

What are the documents needed to register a foreign company in Malaysia?

According to the Malaysian Company Act 2016, there are a few key documents needed in order to register a foreign company in Malaysia. Firstly, you'll need a copy of the Memorandum and Articles of Association of the foreign company. Alternatively, if the articles have not been registered, you'll need a copy of the company's charter, statutes or agreement.

Secondly, you'll need a list of shareholders and directors of the foreign company, as well as their addresses and nationalities. Lastly, you'll need a statutory declaration from a director or an authorized representative that confirms their intention to register the foreign company in Malaysia. Once all these documents have been submitted, registering a foreign company in Malaysia should be a relatively straightforward process.

How many directors and members are needed to register a foreign company in Malaysia?

The Companies Act 2016 stipulates that a foreign company which intends to carry on business in Malaysia must appoint one or more Directors and at least one secretary who is a resident of Malaysia. The foreign company must also have a registered office in Malaysia, and at least one director and one secretary must be resident in Malaysia.

What is the requirement of paid-up capital for a foreign company in Malaysia?

According to the Malaysian Company Act 2016, the minimum amount of paid-up capital for a foreign company is RM 1. Paid-up capital is the total par value of shares that have been paid for by shareholders. This amount must be deposited with a Malaysian bank before commencing business in Malaysia. For certain business activities, a foreign company may be required to have a higher minimum paid-up capital. For more information, please consult with a qualified legal professional in Malaysia.

What is the mandatory submission for a foreign company?

Annual return: Foreign companies are required to file an annual return with the Registrar of Companies within 30 days of the anniversary date of company registration. The annual return must contain information on the company's shareholders, directors, registered address, and principal activities. Foreign companies that fail to comply with these requirements may be subject to penalties.

Audited Report: Each of foreign company in Malaysia has to submit the audited report within 6 months of financial year end. Failing to do so, SSM will impose both late submission fees and compound.

Tax Return: All foreign companies regardless of profit generated have to declare the tax return with IRB within 30 days of the Audit report due.

Form E or employment declaration: Each foreign company in Malaysia has to declare the employment remuneration by submitting form E to IRB in March of each year. Companies will get a penalty if they fail to comply with the IRB regulations.

Is there any audit requirement for a foreign company in Malaysia?

Yes, all foreign companies registered in Malaysia must appoint at least one licensed auditor to audit their accounts. The auditor must be a member of Malaysian Institute of Accountants (MIA) or any other corresponding body that is recognized by the government. Companies are required to submit their audited financial statements within 6 months from the end of the financial year with IRB and with SSM within six months from the date of its annual general meeting (AGM).

Is there any penalty on foreign companies if annual return or audit report is not submitted in time?

Yes, SSM imposes a penalty on foreign companies who do not submit their annual returns or audited reports to the Companies Commission of Malaysia (CCM) within a specified period of time. According to the Malaysian Company Act 2016, a foreign company that fails to submit an annual return within 30 days of its anniversary date and audited report within 6 months of the financial year.

How much is the late submission fee for the mandatory submission to SSM?

The fee for submitting a late application is determined by how long it takes you to complete the task. The fees for failing to submit an application begin at RM 50 and rise to as much as RM 200.

How much is the penalty or compound for the mandatory submission to SSM?

Both company and directors have to pay a penalty charge along with the late submission fees if mandatory submission is not made within the stipulated time. The compound imposed by SSM starts from RM 5000 to maximum RM 50,000 to both company and its directors.